Your 2025 Guide to Finding the Best Personal Loans Online with Low Interest Rates

- Bryan Brown

- May 12, 2025

- 3 min read

In today’s digital age, securing financial help is easier than ever. From consolidating debt to handling unexpected costs or making a large purchase, personal loans offer a practical financial solution. With many lenders now operating entirely online, it’s no surprise that more people are choosing to apply for personal loans online rather than dealing with in-person appointments and paperwork. This guide will help you navigate the world of online lending and find the best personal loans online that match your financial needs in 2025.

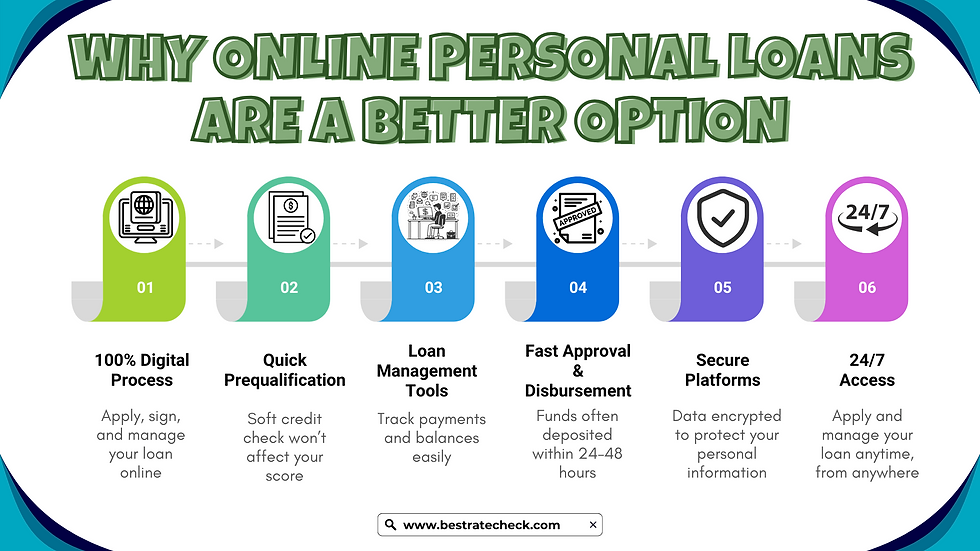

Why More People Are Turning to Online Personal Loans

Advancements in technology have transformed the borrowing process, making personal loans more accessible and convenient. Online personal loans allow borrowers to compare rates, prequalify without affecting their credit scores, and receive funds quickly—sometimes in as little as 24 hours. With the added convenience of digital applications and competitive rates, it's no wonder many are opting for this streamlined approach.

Another huge benefit of online lenders is their transparency. Many platforms display their best personal loan rates upfront, helping you make better financial decisions without the pressure of a sales pitch. These platforms also offer loan calculators, educational resources, and personalized recommendations to make the borrowing process more manageable.

Comparing Lenders to Find the Best Personal Loans Online

When searching for the best personal loans online, it’s crucial to evaluate several factors beyond just the interest rate. Here are some key aspects to consider:

1. Interest Rates and Fees

Borrowers with high credit scores often qualify for the lowest personal loan rates in 2025. However, many online lenders now offer personal loans low interest even to those with fair credit. Be sure to look at both the annual percentage rate (APR) and any origination fees or prepayment penalties. A reduced APR means more of your payments go toward the principal, saving you money in the long run.

2. Loan Terms and Flexibility

Online lenders often provide a wider range of loan terms, from 12 to 84 months. Pick a repayment period that offers manageable monthly payments without significantly increasing your total interest. Some lenders also allow you to change your payment date or offer hardship programs in case your financial situation changes.

3. Speed and Simplicity of the Application

Many platforms make it easy to apply for personal loans online by offering quick pre qualification processes and minimal documentation requirements. This is especially helpful if you need money fast or prefer a no-hassle experience.

4. Reputation and Customer Support

Before committing to a lender, check online reviews and customer ratings. A lender that offers good service, clear terms, and responsive support will make your borrowing experience smoother and more secure.

Top Features of the Best Personal Loan Rates 2025

With so many options available, knowing what sets the best personal loan rates 2025 apart can make all the difference. Look for:

Locked-in interest rates that ensure consistent monthly payments.

No hidden fees or confusing terms

Fast funding—often within one to two business days

Access to loan tracking and management tools online

Customer service that’s easy to reach and responsive to your questions

Remember, the best personal loan rates aren’t always tied to the lowest interest number you see. Sometimes, a slightly higher rate may come from a lender offering better customer support, more flexible terms, or lower fees overall.

Personal Loans Low Interest: Who Qualifies?

If you want access to personal loans low interest, your credit score and financial history will play a big role. Lenders generally look for:

A FICO score of 670 or higher

A steady income source

A low debt-to-income (DTI) ratio

Demonstrated reliability in meeting financial obligations

Don’t let a lower credit score hold you back from exploring loan opportunities. Many online lenders cater to borrowers with average or rebuilding credit, and you may still qualify for a competitive offer with the right application and documentation.

Final Thoughts: Where to Start

Finding the best personal loans online doesn’t have to be overwhelming. By doing your research, comparing offers, and understanding the loan terms, you can make a smart financial move that fits your budget and goals. Always prioritize transparency, low fees, and strong customer reviews when selecting a lender.

Whether you're seeking the best personal loan rates, flexible terms, or simply a faster way to handle your finances, the digital loan space in 2025 offers more choices than ever before. And the best part? Start the application process from the convenience of your home.

If you're ready to apply for personal loan online, or want to compare lenders quickly and easily, be sure to visit Best Rate Check—a trusted resource that helps you compare rates and choose the loan that fits your financial goals.

Comments