Cash Advance vs Payday Loans: What’s the Real Difference?

- Bryan Brown

- May 27, 2025

- 3 min read

When unexpected expenses arise—like emergency medical bills or urgent car repairs—many people turn to short-term financial solutions. Two of the most common options are cash advances and payday loans. Despite their frequent interchangeability, the terms are not interchangeable.

In this guide, we’ll take a closer look at cash advance loans and payday loans to help you understand the key differences—and decide which one is right for your situation.

What Is a Cash Advance?

A cash advance is a short-term loan provided by a credit card company or financial institution. It's essentially borrowing cash against your credit limit. The monies are often accessible by an ATM, a bank, or an internet request.

Types of Cash Advances:

Credit Card Cash Advance: Allows you to withdraw money up to a certain limit using your credit card.

Bank Cash Advance: Some banks offer quick cash based on your relationship with them.

Online Cash Advance Loans: These are typically unsecured, short-term loans provided by online lenders or apps based on your income rather than your credit.

Key Features:

Requires an existing credit line or bank account

Interest accrues immediately (no grace period)

usually entails a cash advance charge (3% to 5%)

Higher APRs than standard credit card purchases

What Is a Payday Loan?

A payday loan is a small, high-interest loan designed to cover expenses until your next paycheck. Payday loans Online are typically available through storefront lenders or online and don’t usually require a credit check.

Key Features:

Loan amounts typically range from $100 to $1,000

Repayment is due in full by your next payday (usually within 2 to 4 weeks)

Requires proof of income

High fees—commonly $15 to $30 per $100 borrowed

No collateral required

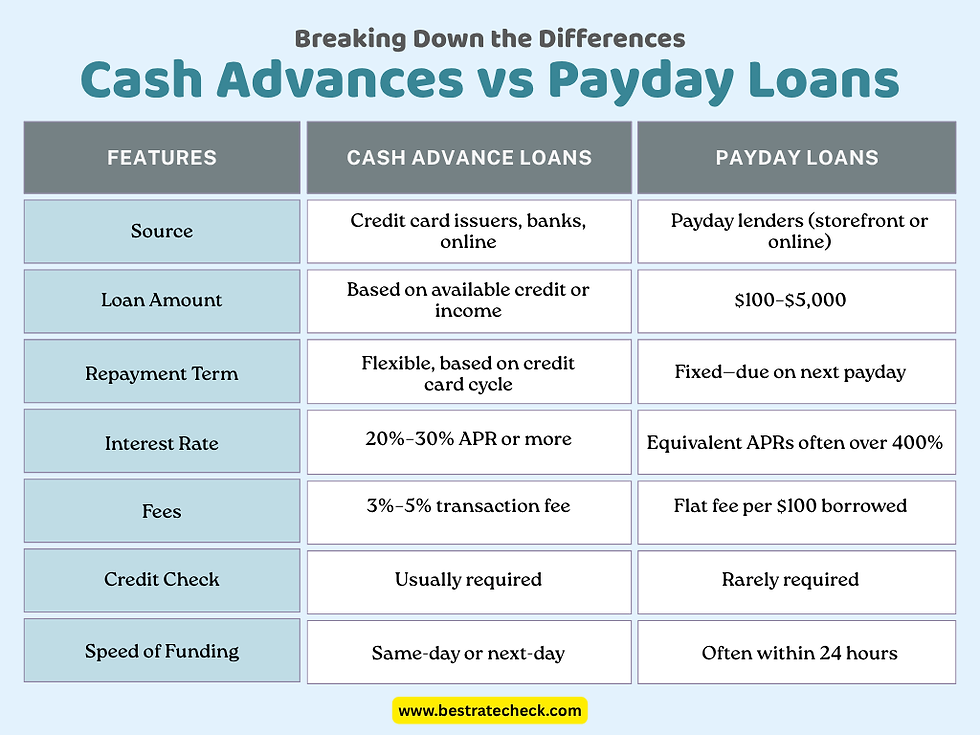

Cash Advance vs Payday Loans: A Direct Comparison

Pros and Cons of Each Option

Cash Advance Loans – Pros:

Convenient if you already have a credit card or bank account

Typically lower cost than payday loans over short periods

Funds available quickly

More flexible repayment terms

Cash Advance Loans – Cons:

Interest starts accruing immediately

High APR and fees

May negatively impact your credit utilization ratio

Payday Loans – Pros:

Accessible with poor or no credit

Fast approval and funding

No collateral required

Payday Loans – Cons:

Extremely high fees and APRs

Short repayment terms can lead to debt cycles

Must be repaid in full, often from your next paycheck

Which Should You Choose?

Choosing between a cash advance loan and a payday loan depends largely on your financial profile, your urgency, and your ability to repay.

Choose Cash Advance Loans if:

You have a credit card or good credit history

You require a small loan with more accommodating terms for payback

You can make quick payments to avoid paying a lot of interest

Choose Payday Loans if:

You don’t have access to credit cards or bank loans

You need emergency cash now

You’re confident you can repay it in full on your next payday

Tips for Smart Short-Term Borrowing

Regardless of the option you choose, here are a few important tips:

Borrow only what you need Don’t overextend yourself just because a lender offers a higher amount.

Read the fine print Know all the terms, including fees, interest rates, and repayment obligations.

Repay on time Timely repayment helps you avoid additional fees and prevents debt buildup.

Explore other options Consider personal loans from credit unions, payment plans from service providers, or borrowing from friends or family if possible.

Conclusion

While cash advance loans and payday loans can both provide quick financial relief in emergencies, understanding the differences between them is essential for making a smart choice. If you have access to a credit card and need more flexible repayment options, a cash advance might be the better fit. On the other hand, if you're dealing with limited credit and need fast cash before your next paycheck, a payday loan could work—just be aware of the higher costs and shorter terms.

Before you commit to any short-term loan, it's important to compare your options and understand the total cost. That’s where Best Rate Check can help. We make it easy to explore competitive loan offers, whether you’re considering a cash advance, payday loan, or another fast funding option. Save time, avoid hidden fees, and find the best rates available—all in one place.

Visit Best Rate Check today and make your next money move with confidence and choose between cash advance loans or payday loans.

Comments